Early Adoption of ASC 606: first glance | Early Adoption of ASC 606: first glance - Audit AnalyticsAudit Analytics

Selecting Modified Retrospective Transition for Adopting ASC 606 and Related Standards - The CPA Journal

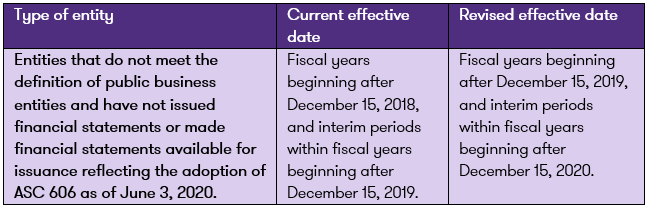

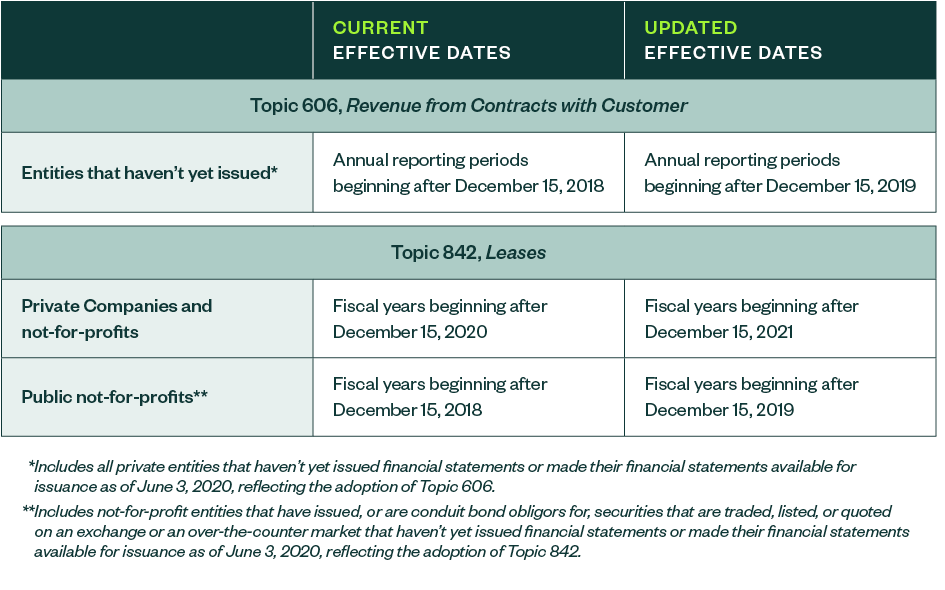

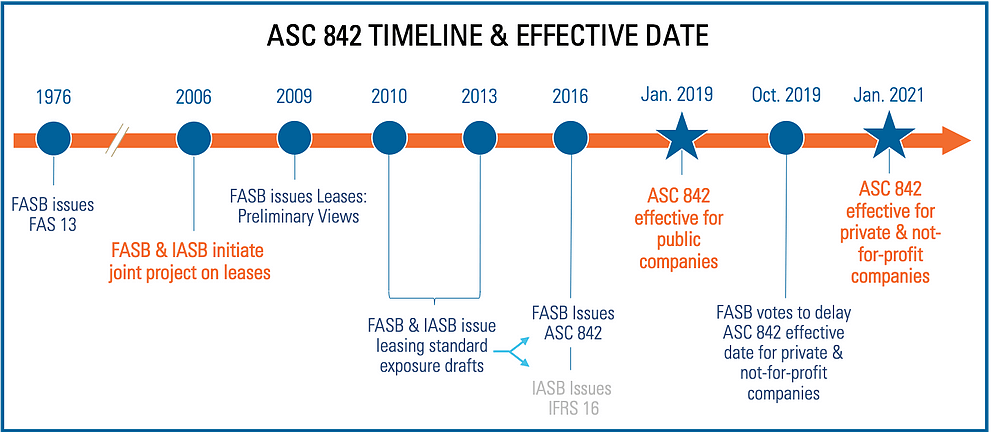

Accounting, Reporting and Other Related Considerations FASB Approves Deferral of Leasing and Revenue Standards for Certain Priv

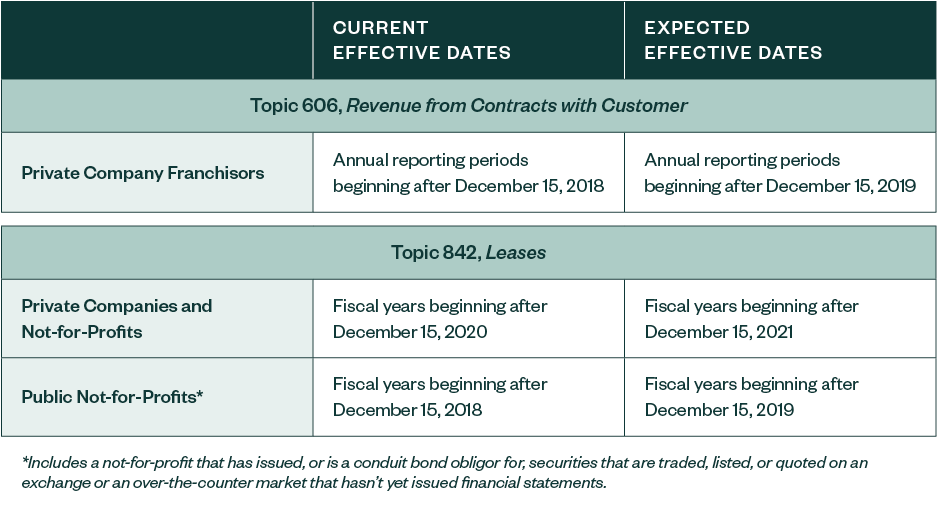

FASB directs staff to draft final ASU delaying revenue recognition and lease standard effective dates - Baker Tilly

FASB Proposes Delaying Effective Date of Certain Standards Due to COVID-19 Pandemic - The CPA Journal